The housing market in Washington State is terrible as it is in many places around the company. Real estate prices are skyrocketing out of control in this area (the greater Puget sound), way beyond what most people can afford. There are "condos," glorified apartments really, selling for $175,000 in some of the worst areas in these parts (Casino Road for the locals). These apartment conversions were built in the 60's, are barely 1000 square feet and are, as mentioned, located in one of the worst parts of this area. A house is going to set you back $300,000 dollars minimum.

And when I say what most people can afford, that means the total price of the house should not be more than one third of your yearly salary. It is relatively easy to get financed on a house you cannot afford, as banks consider your gross income minus expenses such as a car payment. Apparently, banks think no one pays taxes or other expenses such as outrageous power bills or gas.

But not to worry, the bubble will burst. Yes, we are in a bubble, and I am going to prove it. Many economists, probably home owners, claim that this is not a housing bubble. They are looking at only a few statistics such as the cost of rent versus a mortgage payment, the stock market and the value of homes over time. Many are able to skew statistics to make it look like a normal market.

My wife and I are quite comfortable renting (here is a very good article explaining why renting is superior to buying right now). In fact, after doing some research, I have decided to wait because I am convinced that housing prices will drop. After several arguments with friends over the years (real estate agents, loan officers), I decided to do a little research to back my argument. Their argument is "you're throwing your money away" or "house prices are not going to drop any time soon" or my favorite "house prices have always gone up."

The last statement is somewhat true, but what they fail to realize is that they have not accelerated at this rate. Also, historically, home prices have tended to stay within 1/3 of the median income (or close to it). You are not throwing your money away when you rent, as some would have you believe. You are trading your money for a place to live, and getting a great deal in the process, as the article above explains.

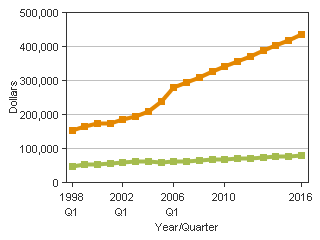

But even if we are not in a "bubble," house prices will drop, or at the very least level off. My argument is simple; The rate of housing prices increase does not match the rate of income increase in this area. Plain and simply, the longer this continues, the fewer number of people will be able to afford a home. I collected statistics for quarter one of every year between 1998 and 2006 from the Washington State University Center For Real Estate Research and compiled statistics and a graph. I also charted out the median incomes and home prices for the next ten years using the average of the difference between the years for each. Go to the statistics page to hover over each dot and see the numbers.

The green line is the median income and the orange line is the median housing price. Look at the gap between the two as time goes on. As that gap widens, fewer and fewer will be able to purchase a home. If this trend continues, only the homeowners will be able to afford to buy a home (using equity and an easier loan process with lessened income restrictions). Notice that the home price in 1998 was 155,800 while the income was 49,173, or about three times the income.

WSU also keeps track of the afford ability index for both new and previous home owners. From their website:

Housing Affordability Index measures the ability of a middle income family to carry the mortgage payments on a median price home. When the index is 100 there is a balance between the family's ability to pay and the cost. Higher indexes indicate housing is more affordable. First-time buyer index assumes the purchaser's income is 70% of the median household income. Some purchased by first-time buyers is 85% of area's median price. All loans are assumed to be 30 year loans.

The Housing Affordability Index according to WSU was 120.8 in 1998 and was reported to be 93.4 in 2006. The first time buyer's HAI for 1998 and 2006 were 67.1 and 54.4 respectively. And the statistics for fourth quarter of 2006 looked worse.

So there may be statisticians out there who say my numbers are skewed, or home owners out there who say I am wrong (more than likely because they feel I am insulting their decision to buy now, or making fun of their hardship due to their outrageous mortgage payment, or are shocked at the thought that their "investment" may not pay off). But I have yet to see an argument that refutes the simple fact that soon enough, few will be able to afford a house or even a condo. The housing market is, like everything else, primarily driven by supply and demand. So your $400,000 dollar house isn't going to do you much good if no one can afford to buy it. It's like having a comic book worth $5000. Only one or two people in the world might pay that, so good luck selling it.

I would like to buy a house someday. Not because of the "investment potential," or the idea of building wealth, buying houses to rent out, to get rich or any other self-serving, greedy reason. No, I want to buy so I can enjoy a decent sized, quiet place to call my own. Not wanting to be "house poor," I'm waiting until the prices drop. And if they don't, I won't buy at all (unless I hit the lotto or get a very, very good job).